Since the formula is yearly based, you should divide the “rate” by 12 to get your monthly interest rate, and multipy “nper” by twelve to get your total month of your loan. You can read the description of those terms in the excel offline help. I put the the formula term next to the input value in the spreadsheet. Why we are using this formula, because our aim is to find the monthly repayment of the loan, based on constant payment and constant interest rate.

I made this to teach my nephew who take finance and accounting school on using excel built-in financial formula to help her understanding loan and mortgage concept.īasically, the excel built-in formula used here is : PMT(rate,nper,pv,). And I didn’t anything special in this spreadsheet. Microsoft Excel put many financial formulas in its software.

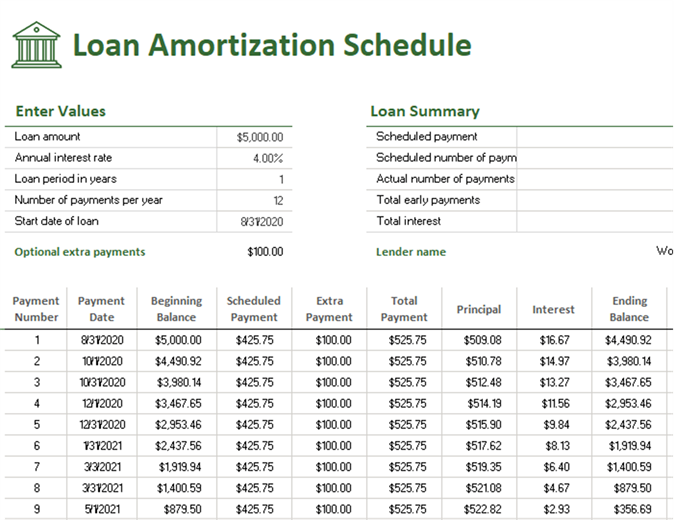

So, you have to carefully calculate and compare any loan schemes before you deciding to have some loan. And this is some kind of strategy to make they pay their loan until the end. Because the calculation, where it is common in all countries, will make they pay interests first rather than make the principal and interest in equal treatment. They still owe more than half of the money they borrowed. Most of the people, like me, in the beginning just knowing that if they loan some money for some period of time, say 5 years, will think that after they pay regularly for 2.5 years, the principal will become half of the money they borrowed. Why this calculator is important ? Because of the interest calculation for loan some money from the bank or financial institution is not a simple calculation. Any banks or financial institution usually provide this tool in their websites to ease their customers calculating their loan schemes before deciding to make a loan. This calculator is one of the most popular calculator that you can find in many internet websites either online or in excel file. This is an amortization schedule calculator you can use to see your amount and payment schedule of your loan.

0 kommentar(er)

0 kommentar(er)